A Legislative Update - FTC: CARS Rule

Note: The FTC CARS rule is currently being challenged legally by the National Automobile Dealers Association and the Texas Automobile Dealers Association. The legal challenges highlight that this rule was an abuse of discretion by the FTC. The 5th Circuit Court of Appeals has agreed to hear the petition.

PIADA is currently working with our national partners and lobbyists to ensure that our industry is properly represented as the new Federal Trade Commission (FTC) rule regarding Combating Auto Retail Scams (CARS) is promulgated. PIADA wanted to ensure that our members are aware of the content of the rule as it could have a drastic impact on our industry.

IMPORTANT NOTE: The FTC CARS rule is currently being challenged legally by the National Automobile Dealers Association and the Texas Automobile Dealers Association. The legal challenges highlight that this rule was an abuse of discretion by the FTC. The 5th Circuit Court of Appeals has agreed to hear the petition.

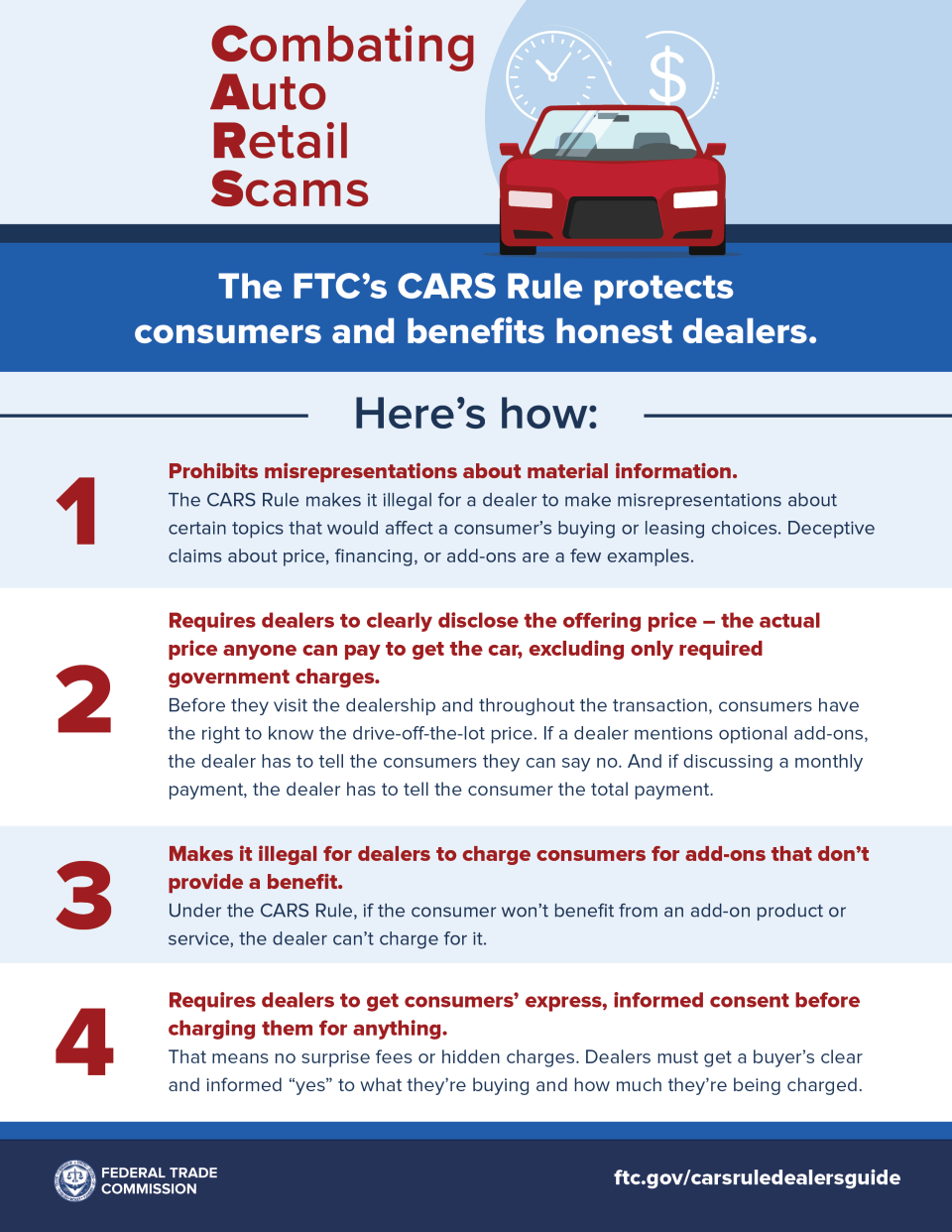

SUMMARY OF THE CARS RULE: The FTC CARS Rule is primarily broken up into 4 parts:

1The CARS Rule Prohibits misrepresentation about material information.

The definition of “material” in this context means “likely to affect a person’s choice of, or conduct regarding, goods or services.” Under this rulemaking the CARS rule would make it illegal for dealers to make misrepresentations about material information in all of these categories:

a. The costs or terms of buying, financing, or leasing a vehicle;

b. Any costs, limitation, benefit, or any other aspect of an add-on product or service;

c. Whether the terms are, or transaction is, for financing or a lease;

d. The availability of any rebates or discounts that are factored into the advertised price but not available to all consumers;

e. The availability of

f. Whether any consumer has been or will be preapproved or guaranteed for any product, service, or term;

g. Any information on or about a consumer’s application for financing;

h. When the transaction is final or binding on all parties;

i. Keeping cash down payments or trade-in vehicles, charging fees, or initiating legal process or any action if a transaction isn’t finalized or if the consumer doesn’t wish to go forward with a transaction;

j. Whether or when a dealer will pay off some or all of the financing or lease on a consumer’s trade-in vehicle;

k. Whether consumer reviews or ratings are unbiased, independent, or ordinary consumer reviews or ratings of the dealer or the dealer’s products or services;

l. Whether the dealer or any of the dealer’s personnel or products or services is or was affiliated with, endorsed or approved by, or otherwise associated with the United States government or any federal, state, or local government agency, unit, or department, including the Department of Defense or any branch of the military;

m. Whether consumers have won a prize or sweepstakes;

n. Whether, or under what circumstances, a vehicle may be moved, including across state lines or out of the country;

o. Whether, or under what circumstances, a vehicle may be repossessed; and

p. Any of the disclosures required by the Rule.

2 The Cars Rule requires dealers to clearly disclose the offering price- the actual price.

The CARS Rule requires dealers to display the offering price of a vehicle clearly and conspicuously. The offering price is defined as the full cash price for which the dealer will sell or finance the vehicle to any consumer. The only costs that can be excluded from the offering price are required government charges. In addition, the offering price must be displayed in any ad that references expressly or by implication a specific vehicle; in any ad that represents, expressly or by implication, any monetary amount or financing term for any vehicle; and in any communication with a consumer that refers, expressly or by implication, to a specific vehicle or to any monetary amount or financing term. If the communication or response is in writing, the offering price must be disclosed in writing.

In addition, the CARS Rule requires that dealers clearly and conspicuously display the fact that add-ons aren’t required, the dealer must clearly disclose that the addon isn’t required, and that the consumer can buy or lease the vehicle without the add-on.

The CARS Rule also requires that dealers clearly and conspicuously display the total of payments for a financed or lease transaction. The dealer must clearly disclose the total amount the consumer will pay after making all payments as scheduled.

Finally, the CARS Rule requires that dealers disclose monthly payment comparisons. If a dealer makes any express or implied comparison between payment options that includes a discussion of a lower monthly payment, the dealer must clearly disclose that the lower monthly payment will increase the total amount the consumer will pay to buy or lease the vehicle if that is the case.

3 The CARS Rule Makes it illegal to charge consumers for add-ons that don’t provide benefit.

According to the current version of the CARS Rule, dealers would be prohibited from charging for add-on products or services if the consumer would not benefit from it. In their explanation of the Rule, the FTC directly cites two examples:

“Examples include charges for “nitrogenfilled tires” that contain no more nitrogen that naturally exists in the air. Other examples are add-ons that don’t provide coverage for the vehicle, the consumer, or the transaction or are duplicative of the car’s warranty coverage. It would be illegal for a dealer to charge consumers for a GAP Agreement – a term the CARS Rule defines – if the consumer’s vehicle or neighborhood is excluded from coverage or the loan-to-value ratio means the consumer won’t benefit financially from the product or service.”

4 The CARS Rule requires dealers to get consumers’ express, informed consent before charging them for anything.

The final change that the CARS Rule makes is to require that dealers must get the consumers’ express, informed consent before charging them for anything. In this instance “express, informed consent” means an affirmative act communicating unambiguous assent to be charged, made after receiving clear and conspicuous disclosures of: (1) what the charge is for and (2) the amount of the charge, including, if the charge is for a product or service, all fees and costs the consumer will be charged over the period of repayment with and without the product service.

PIADA will continue to work in conjunction with our other industry partners to ensure that our industry and specific concerns are represented as this rule proceeds through legal challenges and promulgation.